Sustainable industrial landscape in Mexico and nearshoring.

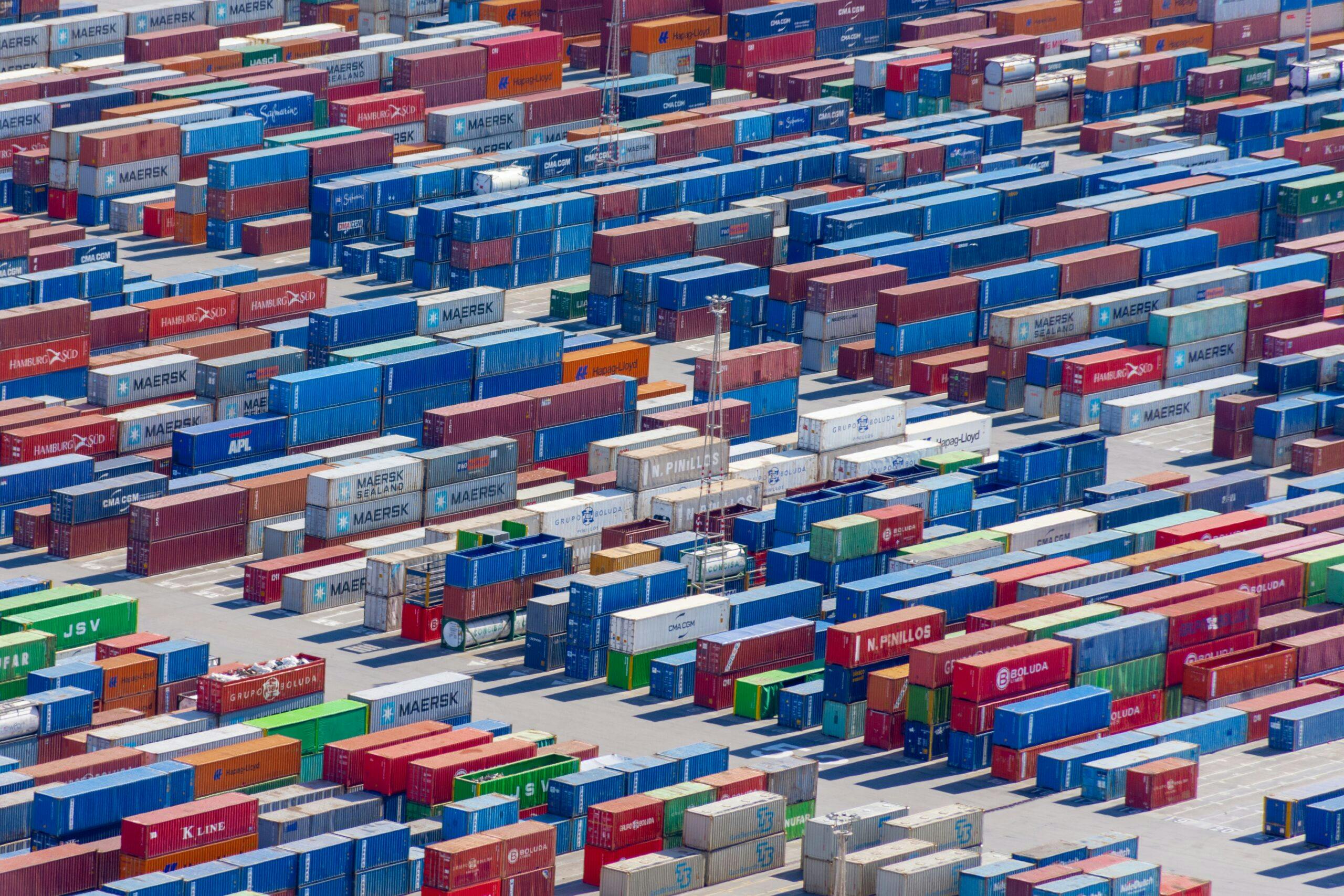

Nearshoring is the practice of moving the production of goods or services to nearby countries; instead of doing it in more distant locations or even in different continents.

In the case of Mexico, nearshoring has gained traction thanks to conditions such as the TMEC trade agreement (with the US and Canada) and the delays and even shortages of goods expected from distant locations (such as China) experienced during the pandemic. Additionally, Mexico’s geographic location makes it an ideal destination for the practice of nearshoring (due to its proximity to key markets in the Americas), along with other benefits such as an accessible and young labor force, the streamlining of certain procedures and even, on certain occasions, some tax facilities; therefore, companies from diverse industries – such as automotive, electronics, textile and aerospace – have established operations in Mexico.

As a result, industrial development in Mexico has not only allowed foreign companies to increase their efficiency and reduce costs, but has also created opportunities to contribute to local environmental sustainability thanks to new projects and the basic requirements of foreign companies.

How’s the situation in Mexico?

The manufacturing industry is one of the main drivers of economic growth in Mexico since, according to INEGI data, during the year 2022 Foreign Direct Investment (FDI) was $35,292 million dollars, an increase of 12% compared to 2021. The United States and Canada stand out as the main investors with $15 million dollars and $3.8 million dollars, respectively. The manufacturing sector accounted for 36% of FDI, in which the manufacturing of automobiles and electronic components stand out, reflecting the companies that have taken advantage of the national territory to carry out their operations.

According to the survey on the Expectations of Economic Specialists in the Private Sector, this investment is expected to continue increasing by 2023.

According to a report issued by the Inter-American Development Bank (IDB), Mexico has become the second most popular destination for this strategy in Latin America, after Brazil.

In addition to low labor costs, Mexico also offers a host of tax incentives and government programs to encourage foreign investment in the country. For example, the Income Tax Law offers a preferential tax rate for companies setting up in certain special economic zones in the country.

LEED certification as a key point in sustainable industrial development

In parallel to the economic development benefits, industrial nearshoring in our country can also have a positive impact on environmental sustainability. First, production in a nearby location reduces travel requirements and, therefore, reduces emissions of greenhouse gases and other air pollutants. In addition, companies that relocate production to Mexico will be able to implement more sustainable production practices, such as reducing energy and water consumption, implementing recycling systems, and adopting more efficient technologies.

Sergio Argüelles González, president of the Mexican Association of Private Industrial Parks (AMPIP), confirmed that 40 investment projects are confirmed for 2023. It is observed that, unlike last year, the origin of the investment is diversified between Asia, Europe and the United States, taking advantage of the T-MEC.

The demand for LEED® certification in the industrial sector has increased due to several factors. First, there is a growing awareness of the importance of sustainability and environmental protection in all aspects of day-to-day life, including industrial development. End users, businesses, developers, financial institutions and government agencies are increasingly interested in sustainability and corporate social responsibility and require confirmations of implemented strategies. LEED certifications are one of the main routes to confirm by an international third party both the company’s commitment and the actions taken to achieve the objectives set. In 2022 alone, 42% of the projects registered in the U.S. GBC were industrial, of which 36 projects achieved certification.

Nearshoring in Mexico offers an opportunity for companies to adopt responsible practices and engage in initiatives to protect the environment and society. In addition, proximity to local communities can allow for greater involvement and collaboration with community groups and non-governmental organizations to address environmental and social issues.

*Based on an emission of 57gCO2 per km traveled for a land trailer trip and 18gCO2 for a sea trip in a container ship.

Sources

(2023). México: Durante 2022 la Inversión Extranjera Directa (IED) fue de 35 mil 292 mdd, lo cual incrementó 12 por ciento en comparación con el año 2021. Retrieved from https://www.gob.mx/se/prensa/durante-2022-la-inversion-extranjera-directa-ied-fue-de-35-mil-292-mdd-lo-cual-incremento-12-por-ciento-en-comparacion-con-el-ano-2021

Comentarios al Informe Estadístico sobre el Comportamiento de la Inversión Extranjera Directa en México (enero-diciembre de 2022) (1.ª ed., pp. 2–5). (2023). (1.ª ed.). Ciudad de México. Retrieved from https://www.cefp.gob.mx/publicaciones/documento/2023/cefp0082023.pdf

Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Marzo de 2023 (1.ª ed., pp. 16–17). (2022). (1.ª ed.). Ciudad de México. Retrieved from https://www.banxico.org.mx/publicaciones-y-prensa/encuestas-sobre-las-expectativas-de-los-especialis/%7B957E5C90-525A-0C48-6CA7-50FA71DC96AF%7D.pdf

González, Lilia. (2023).México: Nearshoring detona ocupación en parques industriales. Retrieved from https://www.eleconomista.com.mx/empresas/Nearshoring-detona-ocupacion-en-parques-industriales-20230215-0144.html